Evaluating & Operating SaaS Companies:

Standard Metrics & Minimum Growth Thresholds

Standard Metrics:

MRR (Monthly Recurring Revenue)

MRR is a familiar metric to any subscription-based company, which is just about 99.9% of saas companies. MRR is all of your recurring revenue normalized into a monthly amount. It’s a metric used to average your various pricing plans & billing periods into a dependable and concise number.

ARR (Annual Recurring Revenue)

ARR is a pretty fundamental metric in the SaaS world. ARR shows how much recurring revenue a startup can expect based on yearly subscriptions.

CAC (Customer Acquisition Cost)

CAC is imperative to understand how much money a company will have to spend to acquire a customer. The most prominent question investors are trying to answer with CAC is how much money the company must spend to acquire a customer.

Churn

Churn is another key metric for SaaS companies. You’ve probably heard it a bunch when hearing comparisons between streaming platforms as of late (or if you follow Matthew Ball on Twitter). Churn is the percentage rate at which SaaS customers cancel their recurring subscriptions. It’s also a significant parameter in forecasting revenue, historically speaking. So churn can give you a pretty good grasp on the rate at which customers will cancel their subscriptions.

Expansion Revenue

Expansion revenue is generated “over & above” the customer’s initial purchasing price or contract. This is mainly driven by either 1) upselling the customer or 2) cross-selling.

Minimum Growth Thresholds:

Now that we understand the standard metrics when evaluating a SaaS company let’s dive into some startup thresholds. Specifically, thresholds associated with growth. For this, I went to David Sacks. If you don’t know who David Sacks is, he’s probably the pound-for-pound champ when it comes to the intersection of operating & investing in SaaS companies. You may recognize the name from my essay on the PayPal Mafia - Sacks was the founding COO at PayPal. He is also currently the founder and general partner at Craft Ventures.

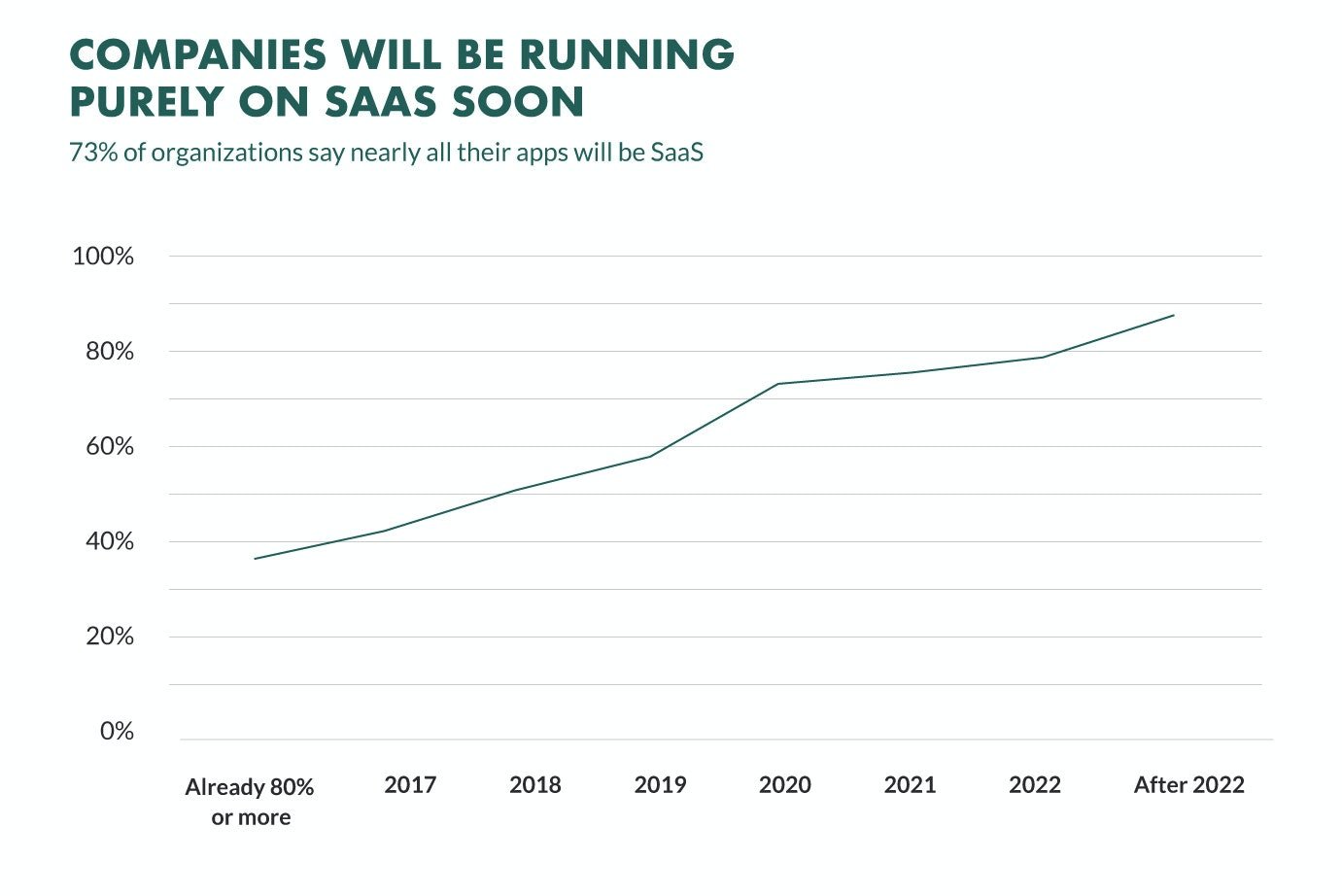

There are a ton of saas startups right now, and there’s going to be even more. Founders are very savvy and know VCs are looking more towards software-based companies that don’t include any hardware (avoids friction around shipping and manufacturing).

For that reason, the increase in SaaS usage and valuations will continue to grow every year.

Trying to consider which companies to evaluate can become overwhelming. Therefore, as an investor, you need to have some thresholds before you start evaluating these startups. Trying to consider which companies to evaluate can become overwhelming.

As an operator/founder, it’s essential to know these thresholds so you can accelerate your chance of scoring a meeting (and eventually funding).

Here is what David Sacks & Craft Ventures look for before they meet with SaaS startups:👇

If the startup is below $1M of ARR: You will want to see about 15-20% of month-over-month growth.

If the startup is between $1M-$5M of ARR: You will want to see the startup at least tripling year-over-year.

If the Startup is $5M+ of ARR: This is a solid foundation (depending on the company’s life cycle), but the startup should still be doubling in ARR every year.

Note: Like all metrics (and all things), you should approach these with a variable base mindset. There have been plenty of startups that have been funded without hitting these thresholds for various reasons. As of late, some of those reasons have usually happened in seed rounds and are related to VC competition and the strength of the tech compared in the past. Either way, it’s still important to look for key metrics. For David Sacks & Craft, startups who have hit these thresholds in the past have gone on to have significant success. If that process is good enough for them, it’s good enough for me to learn and write about.